At Guardian, we are committed to the financial and personal success of our members and the communities we serve. That's why we have partnered with Banzai, a financial literacy program used by millions of teachers and students worldwide, to provide real-world financial resources in a practical and engaging way - all at no cost to you and delivered straight to your home.

Through this partnership, we are committed to empowering individuals with the knowledge and skills necessary to make informed financial decisions, manage debt effectively, plan for retirement, resist financial scams and more. Together, we will help individuals and communities build a foundation for long-term financial stability.

Want to maximize your learning opportunity? Banzai Direct offers five popular courses for all age groups, Banzai Junior, Banzai Teen, Banzai Plus, College and Careers, and Digital Citizenship.

GET STARTED:

- Visitmyguardiancu.banzai.org/and select "GET STARTED" in the top right corner.

- Select your age and click "CONTINUE."

- Agree to the Terms of Use and Privacy Policy and then select "SIGN UP."

- On the Course Selection screen, select from Banzai Junior, Banzai Teen, Banzai Plus, College and Careers, or Digital Citizenship.

- Complete the three program sections:

- Pre-Test: test your current knowledge and see what you know already

- The Game: the main attraction for interactive and engaging learning

- Post-Test: see how much you’ve learned!

Once your account has been created, users can log in and out at any time without losing your progress in the program. Once you've completed your selected program, you can always start again for a refresh or play the game again with friends. And don't forget to have fun - you get to choose your own adventure!

Fast Facts

Studies have shown that individuals with low levels of financial literacy are more likely to accrue high levels of debt. Here are some facts about financial literacy that highlight the importance of promoting financial education and empowerment. The facts below highlight the far-reaching consequences of little access to financial literacy and drive our commitment to promoting financial education and empowerment.

- Debt Levels: According to a survey by the Federal Reserve, total household debt in the United States reached $14.64 trillion in the fourth quarter of 2020.

- Bankruptcy Rates: In the United States, over 800,000 individuals filed for bankruptcy in 2020.

- Retirement Readiness: A report by the National Institute on Retirement Security found that 68% of working individuals ages 25-64 have less than one year's worth of income saved for retirement.

- Vulnerability to Financial Scams: People with low financial literacy are more susceptible to falling victim to financial scams and fraudulent schemes, putting their hard-earned money at risk.

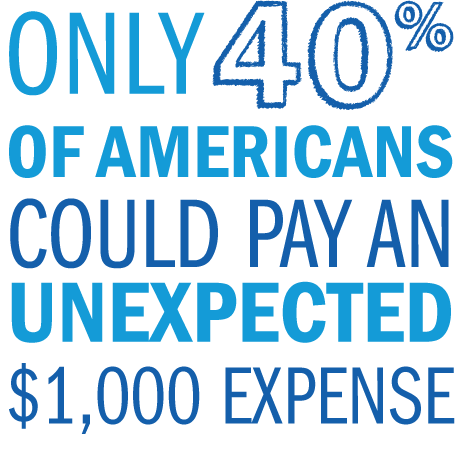

- Savings: Only 40 percent of Americans could pay an unexpected $1,000 expense, such as an emergency room visit or car repair, with their savings, according to a survey from Bankrate.